China is Making Large Inroads into Biotech: Is Investment Money Following? Is US Investment Money Following the China Biotech Boom?

Curator: Stephen J. Williams, Ph.D.

A common route for raising capital or exit strategy for many US biotechs has been strategic transfer or sale of intellectual property (IP) or strategic partnership with large pharmaceutical companies looking to acquire new biotechnologies or expand their own pipelines. Most US based biotechs had enjoyed a favorable (although not fully exclusive) deal-making environment with US pharmaceutical companies with some competition from international biotech companies. US government agencies such as FINRA, CFIUS, and the SEC closely monitored such international deals and the regulatory environment for such international deal making in the biotechnology space was tight.

Smaller Chinese biotechs have operated in the United States (at various biotech hubs around the country) and have usually set up as either service entities to the biotech industry as contract research organizations (Wuxi AppTech), developing research reagents for biotech (Sino Biological) or conducting research for purposes of transferring IP to a parent company in China. Most likely Chinese biotechs set up research operations because of the overabundance of biotech hubs in the United States, with a dearth of these innovation hubs in the China mainland.

However, as highlighted in the Next in Health Podcast Series from PriceWaterHouseCoopers (PwC), China has been rapidly been developing innovation hubs as well as biotech hubs. And Chinese biotech companies are staying home in mainly China and exporting their IP to major US pharmaceutical companies. As PwC notes this deal making between Chinese biotech in China and US pharmaceutical companies have rapidly expanded recently.

The following are notes from PriceWaterHouseCoopers (PwC) podcast entitled: Strategic Shifts: Navigating China’s Biotech Boom and Its Impact on US Pharma:

You can hear this podcast on YouTube at https://music.youtube.com/podcast/iguywci6oG0

Tune in as Glenn Hunzinger, PwC’s Health Industries Leader and Roel van den Akker, PwC’s Pharma and Life Sciences Deals Leader discuss the rapid rise of China’s biotech industry and what it means for U.S. pharmaceutical companies. They discuss the evolving role of Chinese biotech in the global innovation landscape and share perspectives on how U.S. pharmaceutical companies can thoughtfully assess opportunities, manage cross-border complexities, and build effective partnering and diligence strategies.

Discussion highlights:

- China’s biotech industry is growing fast and becoming a global player, with U.S. companies increasingly looking to partner with Chinese firms on cutting-edge science

- U.S. pharma leaders are encouraged to move beyond skepticism and stay curious by building relationships, learning from local innovation, and exploring new partnership opportunities

- Successfully partnering with Chinese biotech firms requires a careful and well-structured approach that accounts for global complexity, protects data and IP, and uses creative deal structures like new company formations to manage risk and stay flexible

- U.S. companies need to be proactive in order to stay competitive by actively exploring global innovation, understanding the risks, and having a clear strategy to bring high-potential science to U.S. patients

Speakers:

Roel Van den Akker, Pharmaceutical and Life Sciences Deals Leader

Glenn Hunzinger, Partner, Health Industries Leader, PwC

Linked materials:

China’s rise as a biotech innovation hub: 4 key strategic questions for US biopharma executives

For more information, please visit us at: https://www.pwc.com/us/en/industries/..

In 2019 there were zero in licensing deals from China to US pharma…. Today one in five come from China.

- China evolved into a expanding economy because China invested in biotech companies

- Lots of skilled people

- Built centers that rivaled biotech innovation centers in places like Boston, California Bay Area, and Philadelphia

China has gone from low cost manufacturing country to an innovative economy with great science coming out of it. US pharma boardrooms need to understand this

The analysts at PWC suggest to look at Data integrity, IP protection and risks before bringing China biotech IP in US. It is imperative that companies do ample due diligence.

China’s rise as a biotech innovation hub: 4 key strategic questions for US biopharma executives

May 08, 2025

Roel van den Akker; Partner, Pharmaceutical & Life Science Deals Leader, PwC

China’s biotech sector is evolving at breakneck speed — and the implications for US pharma are too significant to ignore. Over the past five years, China has transitioned from being a nice to watch market to a central pillar of global biopharma innovation. Today, one-third of in-licensed molecules at US pharma multinationals originate from China, up from virtually zero in 2019.

China’s biotech sector, however, is not monolithic or uniform. The ecosystem spans high-quality, globally competitive biotech hubs in cities like Hangzhou and Suzhou — home to companies producing first-in-class and novel innovations in ophthalmology, cardiovascular, and immunology — as well as a long tail of undercapitalized players where execution and capability gaps remain profound.

And now, Washington is paying attention, too. A recent report from the US National Security Commission on Emerging Biotechnology (NSCEB) highlighted China’s ambitions to dominate biotech as a “strategic priority” with dual-use implications across health and security. The report urges the US government and private sector to reassess dependencies and increase scrutiny of biotechnology partnerships abroad. For the US biopharma industry, this isn’t just a supply chain concern — it is a boardroom issue.

With the licensing market still skewed toward buyers, venture funding remaining depressed in China and IPO windows in Hong Kong slowly reopening, there is a compelling window for US companies to secure differentiated assets at relatively attractive terms. Speedy deal execution is increasingly important as the highest quality assets are being quickly scooped up. But navigating this terrain can require more than opportunism. It calls for deliberate strategy, structured governance and a nuanced geopolitical risk framework.

Here are four questions every US biopharma executive should be asking:

1. What is our posture toward preclinical and clinical science from China?

Are we approaching Chinese innovation with a default posture of skepticism or strategic curiosity? Many top-tier Chinese biotechs are now generating US-caliber data at the speed of light, particularly in therapeutic modalities such as mAbs, ADCs and T-cell engagers, but plenty still have execution gaps. Those that elect to lean in will likely need a deliberate eco-system approach geared towards being the partner of choice and local brand building.

2. What does our China diligence playbook look like?

In light of national security concerns, companies need a China-specific diligence framework — one that goes beyond the science. This includes scrutiny around data integrity, IP protection, export controls, and cross border data sharing.

3. What is our plan post-licensing or acquisition?

Ownership is just the start. US companies need a clear strategy for globalizing China-origin assets — from IND transfers to FDA filing to commercial launch. In some cases, that may require reworking the preclinical package or rebuilding the CMC infrastructure entirely. Increasingly, US (or Europe)-based “Newcos” may serve as geopolitical firewalls.

4. How can we preserve agility amid regulatory and political volatility?

With rising US-China tensions and new export control proposals under review, companies must future-proof deal structures. This could include regional carveouts, US-only development rights, or milestone-gated commitments. The NSCEB report makes clear: passive engagement is no longer tenable.

Innovation strategy meets national interest

The trendlines are clear: China is not just a manufacturing hub — it is an increasingly important source of global biotech innovation. But sourcing innovation from China now sits at the intersection of science, strategy and security. US pharma and biopharma companies can no longer afford to treat China engagement as tactical. Those who adopt a deliberate, resilient and agile China strategy — grounded in scientific rigor and geopolitical realism — likely lead in tomorrow’s innovation race.

Source: https://www.pwc.com/us/en/industries/health-industries/library/china-biotech-sector.html

US pharma bets big on China to snap up potential blockbuster drugs

By Sriparna Roy and Sneha S K

June 16, 202511:26 AM EDTUpdated June 16, 2025

A researcher prepares medicine at a laboratory in Nanjing University in Nanjing, Jiangsu province, April 29, 2011. REUTERS/Aly Song/File Photo Purchase Licensing Rights

- U.S. drugmakers turn to Chinese companies as they face patent expirations

- Licensing deals accelerate while traditional mergers decline

- Chinese biotechs are challenging Western peers, analysts say

June 16 (Reuters) – U.S. drugmakers are licensing molecules from China for potential new medicines at an accelerating pace, according to new data, betting they can turn upfront payments of as little as $80 million into multibillion-dollar treatments.

Through June, U.S. drugmakers have signed 14 deals potentially worth $18.3 billion to license drugs from China-based companies. That compares with just two such deals in the year-earlier period, according to data from GlobalData provided exclusively to Reuters.

How to stop the shift of drug discovery from the U.S. to China. The FDA must make it easier to do such work in the U.S.

Scott GottliebMay 6, 2025

Five years ago, U.S. pharmaceutical companies didn’t license any new drugs from China. By 2024, one-third of their new compounds were coming from Chinese biotechnology firms.

Why are U.S. drugmakers sending their business to China? As in many other industries, it’s so much cheaper to synthesize new compounds inside Chinese biotechnology firms once a novel biological target has been discovered in American laboratories.

Yet the costs of developing new drugs in the U.S. needn’t be so high. They are driven up, in part, by increasing regulatory requirements that burden early-stage drug discovery in America. That’s especially true for Phase I clinical trials, in which drugs are tested in people for the first time.

Newsletter

The smartest thinkers in life sciences on what’s happening — and what’s to come

This shift of discovery work to China is going to accelerate if we don’t take deliberate steps to make it easier to do such work here in America. Yet the imperative to modernize early-stage drug development — to ensure that groundbreaking drug discovery remains in the U.S. rather than migrating to China — is colliding head-on with an impulse to slash the very government workforce capable of spearheading these reforms. These conflicting impulses have created a paradoxical tension: on one hand, the desire to stay competitive with China in biotechnology innovation, and on the other, a parallel campaign to reduce and in some cases dismantle the investments and institutions essential to achieving that goal.

In most cases, Chinese firms are not discovering new biological targets, nor are they crafting genuinely novel compounds to engage these targets through homegrown Chinese research. Instead, they piggyback on Western innovations by scouring U.S. patents, zeroing in on biological targets that are initially uncovered in American labs, and then developing “me too” drugs that replicate American-made compounds with only superficial tweaks, or producing “fast follower” drugs that capitalize on the original breakthroughs while refining key features to try to surpass U.S. innovation. Facing fewer regulations, the Chinese drugmakers can move more quickly than U.S. biotechnology companies — synthesizing copy-cat drugs based on our biological advances and then promptly moving these Chinese-made compounds into early-stage clinical trials, outpacing their American counterparts.

According to the investment bank Jefferies, large American drug companies spent more than $4.2 billion over the past year licensing or acquiring new compounds originally synthesized by Chinese firms. Many comprised advanced compounds such as antibody drugs and cell therapies — underscoring Chinese companies’ growing sophistication in adopting the latest American technologies. The cost of licensing these compounds from China, rather than synthesizing them in American labs, can be significantly lower. At a time when research funding in the U.S. is being cut, and research budgets are becoming painfully stretched, companies are looking to lower the cost of building their pipelines. In a fast-moving field such as oncology, this shift toward Chinese-synthesized compounds is particularly striking: I am told by someone inside the FDA process that nearly three-quarters of new small molecule cancer drugs submitted to the Food and Drug Administration for permission to begin U.S.-based clinical trials are initially made in China.

Usually, only a few months elapse between the moment a U.S. research team publishes a patent identifying a new biological target and when a biotechnology firm in China creates the corresponding drug that capitalizes on these findings. Because Chinese firms can synthesize new molecules at a fraction of the cost incurred by U.S. biotechnology companies — owing to a large and skilled but much cheaper workforce — they find the most intriguing biological targets pursued by Western researchers, rapidly churning out potent yet less expensive copycat molecules that they then market to Western companies.

A major challenge for U.S. firms is the long and costly process of obtaining FDA approval for Phase I studies, in which drugmakers test a new drug’s safety and tolerability in a small group of human volunteers. In China, launching this initial phase of clinical trials is far simpler, giving Chinese biotechnology companies a competitive advantage: By swiftly advancing their molecules into early-stage patient testing, Chinese firms can more readily determine which compounds hit their biological targets and show the greatest therapeutic promise. This allows the Chinese firms to quickly refine their molecules and then leapfrog their American counterparts, who are slowed by more cautious regulatory processes. While China’s regulatory process doesn’t uphold the patient safeguards that Americans rightly insist upon, the U.S. FDA could still streamline its path into early-stage drug development, bolstering America’s competitive edge without compromising patient safety.

In the U.S., one of the costliest early hurdles is the exhaustive animal testing that the FDA requires before a drug can be advanced into Phase I studies. These “pre-clinical” studies help safeguard patients, but the agency also uses this testing to weed out potential failures before a drug requires more intensive FDA scrutiny in later trials.

Over time, this regulatory framework has frontloaded a significant share of costs to the earliest phases of drug development, when biotechnology startups are often running on shoestring budgets, lack clinical data to attract investors, and can least afford delays. One measure of the increasing difficulty in securing the FDA’s permission for Phase I trials is the growing number of U.S. drugmakers who take compounds discovered on American soil and conduct these clinical trials in other Western markets, where they can obtain data more quickly and inexpensively before bringing it back to the FDA. One popular locale is Australia, where costs run about 60% lower than U.S.-based clinical trials, largely because the Australian government offers tax incentives to attract this kind of biomedical investment.

Many animal studies address esoteric questions about a drug’s long-term effects on parameters that may not be relevant to its eventual use — for example, at doses and durations of use that may be far beyond how patients will ultimately use the drug. The FDA’s preclinical testing protocols sometimes require American researchers to administer new compounds to animals at levels up to 500 times higher than any intended dose for patients, aiming for maximum animal exposure before human trials can begin. Where the FDA needs to screen for certain remote risks, many animal studies could be safely deferred until human trials confirm that a drug may benefit patients. At that point, it becomes easier for biotechnology companies to raise capital to fund these pro forma testing efforts.

To modernize the process, the FDA could tap into the wealth of data from existing drugs to establish a more phased approach to these requirements, where the amount of initial animal testing is more closely matched to a drug’s novelty and a better estimation of its perceived risks. It’s a prime opportunity to employ artificial intelligence — mining current data and extrapolating known information to newly discovered molecules. For new molecules that share structural similarities with established drugs, where a robust body of safety information already exists (and the likelihood of uncovering novel risks is judged to be minimal), some animal studies might simply be unnecessary. To establish a graduated approach to the scope of pre-clinical toxicology studies that the FDA requires for new molecules, Congress could revise the agency’s statutory framework, explicitly empowering it to adopt such flexible standards. It would also require targeted investments, enabling the FDA to craft the necessary tools and protocols to implement these refined methodologies.

Mice and even primates are often poor proxies for many of the remote toxicities the FDA is trying to test for, anyway. The agency can also make a more concerted effort to adopt advanced technologies, like pieces of human organs embedded in chips that can be used to test for remote dangers a drug may pose to specific organs like the heart and liver. These tools can reliably screen for risks at a fraction of the time and cost. FDA Commissioner Marty Makary recently announced his intention to pursue a plan that would phase out animal studies in the preclinical evaluation of antibody drugs, shifting instead toward innovative technologies that assess toxicology without relying on live animals. This positive step requires the FDA to invest in new capabilities, and scientific staff that possess expertise in these novel domains.

But right now, that investment seems unlikely. The size and scientific scope of the FDA staff responsible for reviewing early-stage drug development — and evaluating data collected from animal studies — has failed to keep up with the increasing complexity and sheer volume of applications flooding into the agency to launch Phase I clinical trials. Now, the FDA has made deep staffing cuts, prompted by DOGE, that have specifically targeted scientific teams that would lead these essential reforms.

Adding to these woes, morale at the FDA has declined so markedly that many foresee a wave of voluntary resignations among clinical reviewers. By thinning the ranks of experts who tackle novel scientific questions and resolve issues that span across different drug development programs — especially the elimination of the policy office within the FDA’s Office of New Drugs, which adjudicated these kinds of cross-cutting scientific questions — the government has impeded the early dialogue with drug developers that often results in streamlining requirements for Phase I studies. Even more challenging, it weakens the staff’s ability to develop new guidance documents and put better review practices into place — reforms essential for lasting improvements to the preclinical review process.

Instead of strengthening America’s biotechnology ecosystem, such measures risk accelerating the migration of discovery activities to China, undermining innovation at home. When U.S. drugmakers license compounds from China, they divert funds that might otherwise bolster innovation hubs such as Boston’s Kendall Square or North Carolina’s Research Triangle. The U.S. biotechnology industry was the world’s envy, but if we’re not careful, every drug could be made in China.

Scott Gottlieb, M.D., is a senior fellow at the American Enterprise Institute and served as commissioner of the Food and Drug Administration from 2017 to 2019. He is a partner at the venture capital firm New Enterprise Associates and serves on the boards of directors of Pfizer Inc. and Illumina.

From FierceBiotech: US Biotech Companies are finding that foreign investments may put them in a precarious position for government funding

By Gabrielle Masson Jun 18, 2025 11:50am

By Gabrielle Masson Jun 18, 2025

The Department of Health and Human Services is allegedly denying clinical trial funding for biotechs based on their ties to certain foreign investors, Fierce Biotech has learned.

At the BIO conference in Boston this week, Fierce spoke with a biotech executive who had their grant pulled, as well as an industry thought leader who backed up the claims about a change in the HHS’ funding approach.

“We’re in a situation where some of the companies are confused about their ability to take foreign investment,” said John Stanford, founder and executive director of Incubate, a nonprofit organization of biotech venture capital firms and patient advocacy groups designed to educate policymakers on life science investment and innovation.

“We’ve been hearing about SBIR grants canceled,” Stanford told Fierce in a separate interview at BIO. “Anecdotally, we’ve also heard it’s a lot more than China and it’s countries—Canada, Norway, the EU—that traditionally we think of as allies.”

“Again, that’s anecdotal,” he stressed. “But we would be very concerned [about] the idea that we won’t take Canadian investments or Japanese investments or EU-based investments.”

“We want foreign investors coming to U.S.-based companies to develop drugs for the world,” Stanford said. “That is a win-win-win.”

Back in February, President Donald Trump issued a memorandum titled the “America First Investment Policy” that aims to restrict both inbound and outbound investments related to “foreign adversaries” in certain strategic industries. The document lacks specifics but puts China front and center while mentioning both healthcare and biotech among the sectors it will regulate.

And the investment analysis firm Jeffries noted that

Looking at financial data from FactSet, Jefferies analysts found biotech funding in May 2025 was down 57%, to just over $2.7 billion, compared to the same time last year. That sum was only slightly better than the nearly $2.6 billion raised in April — the worst haul in three years — and was also 44% lower than the average seen across the past 12 months.

Source: https://www.biopharmadive.com/news/biotech-funding-trump-policy-ipo-venture-pipe/749784/

But according to other Jeffries analysis biotech investment is not diminishing but realigning and maybe going international:

From Health Tech World: https://www.htworld.co.uk/insight/opinion/biotech-investment-isnt-shrinking-its-smarter-fn25/

Today, total capital remains relatively steady, but it’s flowing differently.

Fewer companies are commanding a greater share of investment, and a new global map of biotech leadership is emerging—one where Israel, Italy, Korea, Saudi Arabia, and NAME are not just participants but strategic innovators and investors in the space.

While some correction was inevitable after the pandemic’s urgency subsided, the sector’s foundation had already changed.

CROs didn’t scale down; they doubled down, offering sponsors the flexibility to develop therapies without taking on the full weight of manufacturing and trials in-house.

This shift underpinned a new era of capital efficiency and strategic outsourcing, which is strongly influenced by new smart technologies that generate code and content at a blink of an eye and refine research protocols.

Selective but Strong: The New Capital Math

After the surge of 2020–2021, a funding correction began in late 2022.

According to Jefferies, biotech funding in May 2025 was down 57 per cent year-over-year, dropping to roughly $2.7 billion.

Public markets also cooled. In 2023, biotech IPOs hit their lowest numbers in a decade, and follow-on offerings became increasingly rare.

This deceleration prompted talk of a “biotech winter.” Yet key indicators suggest a market in transition rather than decline. Private equity and venture capital remain active but are more selective.

While early-stage companies face greater hurdles, late-stage biotechs and those with de-risked clinical programs continue to attract significant funding.

Follow the Late-Stage Money

A recent GlobalData report underscores this trend: late-stage biotech companies now receive nearly double the capital of their earlier-stage counterparts.

Median venture rounds for Phase III companies have climbed to $62.5 million, as investors increasingly prioritise assets with regulatory clarity and near-term commercialisation potential.

The post-COVID period has revealed an important funding shift: fewer biotech companies are securing a larger percentage of available capital.

In an environment of macroeconomic uncertainty, geopolitical risk, and rising interest rates, investors are retreating from speculative bets and doubling down on known quantities.

From Gemini: Is US biotech investment going overseas in 2025? Plot in a bar graph the US biotech investment versus worldwide biotech investment by country

Is US biotech investment going overseas in 2025? Plot in a bar graph the US biotech investment versus worldwide biotech investment by country

Yes the US has many more venture capital firms focused on Biotech investment but it is appearing that investment is not staying in the US.

The global biotech funding landscape in 2023: U.S. leads while Europe and China make strides

[Image courtesy of Sergey Nivens/Adobe Stock]

In 2023, the U.S. continued to demonstrate its position as the biotech funding leader, commanding over one-third, 35%, of the global investment in the sector. Overall, U.S. biotech firms attracted $56.79 billion in funding, according to a survey of Crunchbase data. Next in line was China, which contributed about 12.7% to the global funding pool, or $20.61 billion. Up next was Europe, which secured more than $11.46 billion and representing more than 7% of the worldwide funding.

While U.S. leads in total biotech funding, Chinese biotech companies, on average, saw larger funding rounds than either Europe or the U.S. The average funding size per company in China was roughly three times larger than that in the U.S. and six times larger than the average in Europe.

But while China-based companies had larger hauls, they were comparatively few. Chinese biotech secured in cumulative $20.61 billion among just 69 firms, with roughly $299 million in funding per company on average. Meanwhile, the 229 European biotech firms that won funding in the past year attracted $11.46 billion in funding, averaging $50 million each. In comparison, the 583 U.S. biotech companies with recent funding attracted $56.79 billion, averaging $97 million per company.

The map below represents the total biotech funding amount in USD across the globe. Funding amounts are shaded based on companies’ cumulative funding totals and density. Darker shades indicate higher funding amounts and density, with the U.S. hubs on the East and West Coasts showing the darkest shade, reflecting the combination of total funding and density.

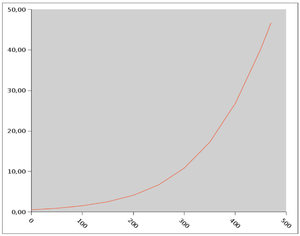

The Chinese Biotech Market is expected to grow to over 800 million in 2025. This is on the heels of phenomenal growth from 2013, where almost a ten fold increase in market size growth has been seen from 2013 to 2025. Source: https://www.franklintempleton.co.uk/articles/2025/clearbridge-investments/china-emerging-as-a-global-biotechnology-player

Size of the US Biotech Market is expected to grow from half a billion in 2023 to 1.7 trillion in 2033. Source novaoneadvisor.com

Biotech investment trends in the US for 2025 present a complex picture. While some reports indicate a general slowdown in venture funding for biotech startups and concerns about tariff impacts, other sources suggest resilience within the sector, with strong revenue growth for public biotech companies in both the US and Europe in 2024, expected to continue into 2025. Additionally, there are calls for significant investment within the US to maintain its leadership in biotechnology. Therefore, it is not definitively clear that US biotech investment is predominantly going overseas in 2025, but rather navigating a challenging and evolving landscape.

Regarding US biotech investment versus worldwide biotech investment by country, here is a bar graph of key biotech investment moves in 2025 based on available data. Please note that this data reflects “key moves” in biotech funding for 2025 as reported by Labiotech, and a comprehensive worldwide investment breakdown for all countries was not available.

From Franklin Templeton: China is Emerging as a Global Biotechnology Player

See Source for more: https://www.franklintempleton.co.uk/articles/2025/clearbridge-investments/china-emerging-as-a-global-biotechnology-player

The combined value of China’s outside licensing deals reached around US$46 billion in 2024, up from US$38 billion in 2023 and US$28 billion in 2022, according to data provider NextPharma. Meanwhile, the number of global companies licensing into China has decreased across the same period. These tailwinds have helped China expand its share of global drug development to nearly 30% compared to 48% for the United States, according to data provider Citeline. Strong IP protection has positioned China to receive global investment, with a 2024 policy encouraging more IP collaboration between global and Chinese companies. US investment bank Stifel projects that molecules licensed by large pharmaceutical firms from China will increase to 37% in 2025. This shift has been largely driven by US companies seeking cheaper drug development alternatives and has led to R&D spending in China outpacing that of the United States.

A Closer Look at the Financials and Comparison between China and US Biotech Investment Trends

This rapid growth of Chinese biopharma was predictable back in 2018 as this article from an investment newsletter suggests:

China’s Biopharma Industry: Market Prospects, Investment Paths

November 10, 2022Posted by China BriefingWritten by Yi WuReading Time: 5 minutes

Biopharma, short for biopharmaceuticals, are medical products produced using biotechnology (or biotech). Typical biopharma products include pharmaceuticals generated from living organisms, vaccines, gene therapy, etc.

An important subsector of biotech, China’s biopharma industry has much attention home and abroad, especially after Chinese companies developed multiple COVID-19 vaccines now in wide circulation. Market capitalization of Chinese biopharma companies grew to over US$200 billion in 2020 from US$1 billion in 2016.

With China’s rapidly aging population and a growing affluent middle-class, the country’s biopharma industry presents challenging but compelling opportunities to investors.

In this article, we discuss the market size, growth drivers, and global competition facing China’s biopharma industry and suggest potential investment paths.

How big is China’s biopharma market?

Biopharmaceuticals in China is a lucrative business, with significant domestic demand due to an aging population and expanding household budgets for quality products and services as people’s living standards improve.

China’s healthcare market is predicted to expand from around US$900 billion (RMB 6.47 trillion) in 2019 to US$2.3 trillion (RMB 16.53 trillion) in 2030, and its market size is second to only the US. China’s total expenditure on healthcare as a component of its GDP increased to 5.35 percent in 2019 from 4.23 percent in 2010.

Specifically to the biopharma industry, the market size will likely grow from RMB 345.7 billion (US$47.60 billion) in 2020 to RMB 811.6 billion (US$111.76 billion) in 2025, an 135 percent increase in five years. Similarly, market capitalization of Chinese biopharma companies grew from US$1 billion in 2016 to over US$200 billion in 2020. From 2010 to 2020, 141 new drug and biotech companies were launched in China, doubling from the previous decade.

What are the growth drivers for China’s biopharma industry?

The broader biotech sector is a main focus of the Chinese government’s “Made in China 2025” strategy. The country needs a steady biopharmaceutical industry to address its healthcare needs and to build an internationally competitive and innovative pharmaceutical industry as part of wider economic restructuring. Under the same momentum, on January 30, 2022, nine agencies jointly issued the “14th Five-year Plan for the Development of the Pharmaceuticals Industry” as a guiding document that clarifies the goals and directions for China’s pharmaceutical industry development in the next five years.

Now let’s compare the size of the US biotech market: You can see the US biotech valuation is now similar to the estimated market capitalization of the China market.

The U.S. biotechnology market size was valued at USD 621.55 billion in 2024 and is projected to reach USD 1,794.11 billion by 2033, registering a CAGR of 12.5% from 2024 to 2033. Ongoing government initiatives are the key factors driving the growth of the market. Also, improving approval processes coupled with the favorable reimbursement policies can fuel market growth further.

Key Takeaways:

- DNA sequencing dominated this market and held the highest revenue market share of 18% in 2023

- The others’ segment is anticipated to grow at the fastest CAGR of 28.1% during the forecast period.

- The health segment dominated the market and accounted for the largest revenue market share of 44.13% in 2023.

- Bioinformatics is expected to witness the fastest growth, with a CAGR of 17.2% during the forecast period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/8456

The U.S. biotechnology market is witnessing major growth contributed by the increasing adoption and applications of biotechnology in many industries like pharmaceuticals, agriculture, food production, environmental conservation, and energy. In addition, market players in the industry are increasingly focusing on innovations across many fields such as energy, medicine, and materials science using biological processes to overcome challenges and fuel technological advancements. Also, in recent years there has been a notable surge in the utilization of biotechnological methods including DNA fingerprinting, stem cell technology, and genetic engineering propelling the market expansion soon.

From BioPharmaDive

Source: https://www.biopharmadive.com/news/biotech-us-china-competition-drug-deals/737543/

‘The bar has risen’: China’s biotech gains push US companies to adapt

A fast-improving pipeline of drugs invented in China is attracting pharma dealmakers, putting pressure on U.S. biotechs and the VC firms that back them.

Published Jan. 16, 2025

Senior Editor

Soon after starting a new biotechnology company, David Li realized he needed to rethink his strategy.

Li had been conducting the competitive research biotech entrepreneurs typically undertake before soliciting investment. He drew up a list of drug targets that his startup, Meliora Therapeutics, could pursue and checked them against the potential competition.

Li quickly found that biotechs in China were already working on many of the targets he had on his list. Curious, he visited Shanghai and Suzhou and witnessed a buzzing scene of startups set frenetically to task.

The latest developments in oncology research

“They’re not really thinking about the U.S. at all. They’re just trying to create more value and stay alive to differentiate themselves from the next guy in China,” he said. “They’re moving quick. There are a lot of them and they’re just quite competitive.”

Li’s experience is illustrative of a trend that could pressure biotech companies in the U.S. and alter their drug development strategies. More and more, large pharmaceutical companies are licensing experimental drugs from China. Venture companies are testing similar tactics by launching new U.S. startups around compounds sourced from China’s laboratories. This shift has been sudden, with licensing deals ramping rapidly over the past two years. And it is occurring even as the shadow of U.S.-China competition within biotech grows longer.

Executives and investors interviewed by BioPharma Dive at the J.P. Morgan Healthcare Conference this week share Li’s outlook. They expect such deals will accelerate and, in the process, force U.S. biotechs to work harder to stand out.

“We’ve been warning people for a while, we’re losing our edge,” said Paul Hastings, CEO of cell therapy maker Nkarta and former chair of the U.S. lobbying group the Biotechnology Innovation Organization. “Innovation is now showing up on our doorstep.”

There’s perhaps no clearer example of this than ivonescimab, a drug developed by China-based Akeso Therapeutics and licensed by U.S.-based Summit Therapeutics. Recent results from a lung cancer study run in China showed ivonescimab outperformed Keytruda, Merck’s dominant immunotherapy and currently the pharmaceutical industry’s most lucrative single product.

The finding “put a huge focus on what’s happening in China,” said Boris Zaïtra, head of business development at Roche, which sells a rival to Keytruda.

Fast-moving research

Today’s deal boom has roots in efforts by the Chinese government to upgrade the country’s biotech capabilities by upping investment in technological innovation. In the life sciences, the initiative provided funding, discounted or even free laboratory space and grants to support what Li described as a “robust ecosystem” of biotechs.

The results are clear. Places like Shanghai and Suzhou are home to a skilled workforce of scientists and hundreds of homegrown companies that employ them. Science parks akin to the U.S. biotech hubs of Cambridge, Massachusetts and San Francisco have sprouted up.

Chinese companies generally can move faster, and at a lower cost, than their U.S. counterparts. Startups can go from launch to clinical trials in 18 months or less, compared to a few years in the U.S., Li estimated. Clinical trial enrollment is speedy, while staffing and supply chain costs are lower, helping companies move drugs along more cost effectively.

“If you’re a national company within China running a trial, just by virtue of the networks that you work within, you pay a fraction of what we pay, and the access to patients is enough that you can go really fast,” said Andy Plump, head of research at Takeda Pharmaceutical. “All of those are enablers.”

And what they’ve enabled is a large and growing stockpile of drug prospects, many of which are designed as “me too better” versions of existing medicines, analysts at the investment bank Jefferies wrote in a December report. Initially focused in oncology, China-based companies are now churning out high-quality compounds across multiple therapeutic areas, including autoimmune conditions and obesity.

“There was a huge boom of investment in China, cost of capital was very low, and all these companies blew out huge pipelines,” said Alexis Borisy, a biotech investor and founder of venture capital firm Curie.Bio. ”Anything that anybody was doing in the biotech and pharmaceutical industry, you could probably find 10 to 50 versions of it across the China ecosystem.”

Me-toos become me-betters

For years now, Western biopharma executives have scouted the pipelines of China’s biotech laboratories — exploration that yielded a smattering of licensing deals and research collaborations. Borisy was among them, starting in 2020 a company called EQRx that sought to bring Chinese versions of already-approved drugs to the U.S. and sell them for less. EQRx’s plan backfired amid scrutiny by the U.S. Food and Drug Administration of medicines tested only in people from a single country.

Now, however, the pace of deals has accelerated rapidly. There are a few reasons for this. According to Plump, one is the improving quality of the drug compounds being developed. The “me toos” are becoming “me betters” that could surpass available therapies and earn significant revenue for companies — like BeiGene’s blood cancer drug Brukinsa, which, in new prescriptions for the treatment of leukemia, overtook two established medicines of the same type last year.

Another reason, Plump said, is that China-based companies are becoming more innovative, studying drug targets that might not have yet yielded marketed medicines, or for which the most advanced competition is in early testing. Li notes how Chinese companies are going after harder “engineering problems,” like making complex, multifunctional antibody drugs, or antibody-drug conjugates.

“There are so many [companies] that the new assets are going to keep coming,” Li said.

Inside the market strategies of today’s drugmakers

Much as in the U.S., China-based biotechs are also fighting for funding, pushing them to consider licensing deals with multinational pharma companies. At the same time, these pharmas are hunting for cheap medicines they can plug into their pipelines ahead of looming patent cliffs. The two trends are “colliding,” said Kristina Burow, a managing director with Arch Venture Partners. “I don’t see an end to that.”

The statistics bear Burow’s view out. According to Jefferies, the number and average value of deals for China-developed drugs reached record levels last year. Another report, from Stifel’s Tim Opler, showed that pharma companies now source about one-third of their in-licensed molecules from China, up from around 10% to 12% between 2020 and 2022.

“I see huge opportunities for us to partner and work together with Chinese companies,” said Plump, of Takeda.

Several venture-backed startups have been built around China-originated drugs, too, among them Kailera Therapeutics, Verdiva Bio, Candid Therapeutics and Ouro Medicines, all of which launched with nine-figure funding rounds.

“There’s been a lot of really good, high quality molecules and data that have emerged from China over the last couple of years,” said Robert Plenge, the head of research at Bristol Myers Squibb. “It’s also no longer just simply repeating what’s been done with the exact same type of molecule.”

Geopolitical risks

These deals are happening against an uncertain backdrop. The U.S. Congress has spent the last year or so kicking around iterations of the Biosecure Act, a bill that would restrict U.S. biotechs from working with certain China-based drug contractors. A committee in the House of Representatives is calling for new limits on clinical trials that involve Chinese military hospitals. And the incoming Trump administration has threatened tariffs that could ripple across industrial sectors.

“We don’t know what this new administration is going to do,” said Jon Norris, a managing director at HSBC Innovation Banking.

The Biosecure Act “keeps going sideways,” added Hastings, who believes that any impact from the legislation, if passed, would be minimal. Instead, Hastings wonders if future tariffs may be more problematic. “There will be tariffs on other goods coming from China. Does that include raw materials and innovation? It’s hard to imagine that it won’t,” he said.

But executives and investors expect deals to continue, meaning U.S. biotechs will have to do more to compete.

“U.S. companies will need to figure out what it is they’re able to bring to the table that others can’t,” said Burow, of Arch.

Borisy said startups working on first-of-their-kind drugs need to be more secretive than ever. “Do not publish. Do not present at a scientific meeting. Do not put out a poster. Try to make your initial patent filing as obtuse as possible,” he cautioned.

“The second that paper comes out, or poster at any scientific meeting, or talk or patent, assume it has launched a thousand ships.”

Those that are further along should assume companies in China will be quick on their heels with potentially superior drugs. “The day when you could come out with a bad molecule and open up a field is over,” he said.

Greater competition isn’t necessarily a bad thing, according to Neil Kumar, CEO of BridgeBio Pharma. Drug development could become more efficient as pharmas acquire medicines from a “cheaper” starting point and advance them more quickly.

Venture dollars could be directed towards newer ideas, rather than standing up a host of similar companies.“If all of a sudden this makes us less ‘lemming-like,’” Kumar said, “I have no problem with that.”

Li similarly argues that, going forward, U.S. companies need to focus on “novelty and innovation.” At his own company, Li is now working on things “we felt others were not able to access.”

“The game has always been the same. Bring something super differentiated to market,” he said. But “the bar has risen.”

Gwendolyn Wu and Jacob Bell contributed reporting.

Is Chinese Biotechs just Producing Me-Too Drugs or are they Innovating New Molecular Entities?

The following articles explain the areas in which Chinese Biotech is expanding and focused on.

However the sort answer and summary to the aforementioned question is: Definately Chinese Biotechs are innovating at a rapid pace, and new molecular entities and new classes of drugs are outpacing any copycat or mee-too generic drug development.

This article by Joe Renny on LinkedIn focuses on the degree of innovation in Chinese biotech companies. I put the article in mostly its entirety because Joe did an excellent analysis of China’s biotech industry.

You can see the full article here: https://www.linkedin.com/pulse/copy-chinas-biotech-boom-can-really-solve-pharmas-roi-joe-renny-rerge/

China’s Biotech Boom: Can It Really Solve Pharma’s ROI Problem?

China’s biotech sector is in the midst of a stunning surge – its stocks have skyrocketed over 60% this year (outpacing even China’s high-flying tech sector), and the country now has over 1,250 innovative drugs in development, nearly catching up with the U.S. pipeline of ~1,440. Once known mainly for generic manufacturing, China is rapidly emerging as a source of differentiated innovation. Global pharma giants have taken notice: major licensing deals are proliferating as Western drugmakers snap up Chinese-born therapies in fields like oncology, metabolic diseases (obesity/diabetes), and immunology. The excitement is palpable – but a critical question looms beneath the optimism: Can this wave of innovation meaningfully improve the pharmaceutical industry’s return on investment (ROI)? In other words, will China’s biotech boom fix the underlying economics of drug development, or are the same old ROI challenges here to stay?

From Copycats to Cutting-Edge: China’s Rapid Ascent in Biotech

In the past decade, China’s pharma landscape has transformed from copycat chemistry to cutting-edge biotech. The sheer scale of innovation is unprecedented. A recent analysis found China had over 1,250 novel drug candidates enter development in 2024, far surpassing the EU and nearly reaching U.S. levels. This is a remarkable jump from just a few years ago – back in 2015, China contributed only ~160 compounds globally. Reforms to streamline drug approvals and massive R&D investments (spurred by initiatives like Made in China 2025) have unleashed a boom led by returnee scientists and ambitious startups.

Importantly, the quality of Chinese innovation has leapt upward alongside quantity. Drugs originating in China are increasingly clearing high bars of efficacy and safety. The world’s strictest regulators, including the U.S. FDA and European EMA, have begun fast-tracking more Chinese-developed drugs with priority reviews and “breakthrough” designations. For example, a cell therapy for blood cancer developed by China’s Legend Biotech won FDA approval (marketed by Johnson & Johnson) and is considered superior to a rival U.S. therapy. Another China-origin drug – Akeso Inc.’s novel cancer antibody that outperformed Merck’s Keytruda in trials – triggered a global wave of interest and a $500 million licensing deal in 2022. In short, China is no longer just a low-cost manufacturing base; it’s producing world-class treatments that Big Pharma is eager to get its hands on.

This trend is also evident in the stock markets. After a four-year slump, Chinese biotech stocks have roared back, becoming one of Asia’s best-performing sectors in 2025. The Hang Seng Biotech Index in Hong Kong is up over 60% since January, vastly outperforming broader tech indices. Investors are excited by signals that China is becoming a true global hub for biopharma innovation. According to one analyst, “China biotech is now a disruptive force reshaping global drug innovation… The science is real, the economics are compelling, and the pipeline is starting to deliver”. All of this represents a fundamental shift in the industry’s centre of gravity – and perhaps a new source of competitive pressure on Western incumbents.

Western Pharma’s Response: Licensing Deals and Partnerships Accelerate

Global pharmaceutical companies aren’t standing on the sidelines – they’re rushing to collaborate with and invest in Chinese biotechs. In fact, U.S. and European drugmakers have dramatically stepped up licensing deals to tap China’s innovations. Through the first half of 2025 alone, U.S. companies signed 14 licensing agreements worth up to $18.3 billion for Chinese-origin drugs, a huge jump from just 2 such deals in the same period a year earlier. Many of these partnerships involve potential blockbusters in cancer, metabolic disorders, and other areas where Chinese R&D is making leaps.

- Oncology: China has become a hotbed for cancer drug innovation, especially with advanced biologics like bispecific antibodies. In May 2025, Pfizer paid a record $1.25 billion upfront to license a PD-1/VEGF bispecific antibody from China’s 3SBio (a deal worth up to $6 billion with milestones). Weeks later, Bristol Myers Squibb struck an $11.5 billion alliance for a similar immunotherapy developed in China. Virtually every active clinical trial for certain cutting-edge cancer combos (like PD-1/VEGF drugs) now originates in China, making it a goldmine for Western firms seeking the next breakthrough. AstraZeneca, Merck, Novartis, and others have all scooped up Chinese cancer therapies in recent years as they cast their nets wider for innovation.

- Metabolic & Obesity Drugs: Western pharma is also eyeing China’s contributions in metabolic diseases. Notably, Merck licensed a Chinese-developed GLP-1 oral drug (for diabetes/obesity) from Hansoh Pharma in late 2022 for up to $1.7 billion. And in 2025, Regeneron paid $80 million upfront (in a deal worth up to $2 billion) for rights to an experimental obesity drug from Hansoh. These deals underscore that Chinese labs are producing competitive candidates in the red-hot obesity/diabetes arena – an area of huge global market potential.

- Autoimmune & Other Areas: While oncology leads, Chinese biotechs are also advancing novel therapies in immunology and autoimmune diseases. For example, multiple deals in 2024–25 have focused on inflammatory conditions and neurology, indicating breadth in China’s pipeline. As one industry banker observed, roughly one-third of all new assets licensed by large pharmas in 2024 originated from China, and this could rise to 40–50% in coming years. In other words, nearly half of Big Pharma’s in-licensed pipeline may soon be sourced from China – a radical change from a decade ago.

Underpinning this deal frenzy is a stark reversal of roles: China has shifted from mostly importing therapies to now exporting its homegrown innovations. Back in 2015, Chinese companies mainly signed “license-in” deals to bring foreign drugs to China. But by 2024, nearly half of China’s transactions were license-out deals, with Chinese firms granting global rights to their own drugs. In 2024 alone, Chinese biotechs out-licensed 94 novel projects to overseas partners, often at early clinical stages. This boom in outbound deals – especially for high-value cancer therapies (like ADCs and bispecific antibodies) – highlights China’s maturation as an innovation engine.

In a scientific paper published by Yan et al, the authors provided a comparative analysis between the US, EU, and China of new approved drugs from the years 2019- 2023.

Yan Y, Guo X, Li Z, Shi W, Long M, Yue X, Kong F, Zhao Z. New Drug Approvals in China: An International Comparative Analysis, 2019-2023. Drug Des Devel Ther. 2025 Apr 3;19:2629-2639. doi: 10.2147/DDDT.S514132.

In the paper, the authors retrieved approval data from from the National Medical Products Administration (NMPA), Food and Drug Administration (FDA), European Medicines Agency (EMA), and Pharmaceuticals and Medical Devices Agency (PMDA), including information on the generic name, trade name, applicants, target, approval date, drug type, approved indications, therapeutic area, the highest R&D status in China, and special approval status. The approval time gaps between China and other regions were calculated.

Results: Interestingly, China led with 256 new drug approvals, followed by the US (243 approvals), the EU (191 approvals), and Japan (187 approvals). Oncology, hematology, and infectiology were identified as the leading therapeutic areas globally and in China. Notably, PD-1 and EGFR inhibitors saw substantial approval, with 8 drugs each approved by the NMPA. China significantly reduced the approval timeline gap with the US and the EU since 2021, approving 15 first-in-class drugs during the study period.

The authors concluded, that despite the COVID-19 years, Chinese biotech has rapidly innovated in the biotech space and made up for the time gaps with increased research productivity.

Number of drug approvals by regulatory agency. Source: Yan Y, Guo X, Li Z, Shi W, Long M, Yue X, Kong F, Zhao Z. New Drug Approvals in China: An International Comparative Analysis, 2019-2023. Drug Des Devel Ther. 2025 Apr 3;19:2629-2639. doi: 10.2147/DDDT.S514132.

A comparison of drug approvals in US and China, as percentage of clinical use in various disease states. Source: Yan Y, Guo X, Li Z, Shi W, Long M, Yue X, Kong F, Zhao Z. New Drug Approvals in China: An International Comparative Analysis, 2019-2023. Drug Des Devel Ther. 2025 Apr 3;19:2629-2639. doi: 10.2147/DDDT.S514132.

China Biotech Innovation Hubs

The following was generated by Google AI

China has several prominent biotech innovation hubs, with the Yangtze River Delta region (including Shanghai, Suzhou, and Hangzhou) and Beijing being particularly strong. These regions leverage strong academic and research institutions, high R&D expenditures, and significant investment to foster a vibrant biotech ecosystem.

Here’s a closer look at some key hubs:

Yangtze River Delta:

- Shanghai:

A major hub with a focus on oncology, cell and gene therapy, and a strong track record of biotech IPOs. It’s home to the Zhangjiang Biotech and Pharmaceutical Base, known as China’s “Medicine Valley”. - Suzhou:

Known for the BioBay industrial park, which houses numerous biotechnology and technology companies. - Hangzhou:

Features a growing biotech sector, with companies like Hangzhou DAC Biotech.

Other Notable Hubs:

- Beijing:

A major hub for biotech innovation, with strong academic and research institutions like Tsinghua University and the Chinese Academy of Sciences. - Guangzhou:

The Guangzhou International Bio Island focuses on regenerative medicine, gene editing, and molecular diagnostics. - Wuhan:

Wuhan Biolake is a key player in areas like biomedicine, bio-agriculture, and bio-manufacturing. - Shenzhen:

Features an innovation hub that supports synthetic biology startups and accelerates the commercialization of new biotech materials.

Key Factors Driving Growth:

- Strong government support and investment:

China has been actively promoting the growth of its biotech sector through various initiatives and funding programs. - High R&D expenditures:

China is investing heavily in research and development, particularly in the tech, manufacturing, and biotech sectors. - Increasingly strong talent pool:

China is producing a growing number of STEM graduates and globally recognized researchers. - AI and technology integration:

AI is being applied to drug design and discovery, accelerating innovation. - Focus on specific areas:

Different hubs are specializing in areas like oncology, regenerative medicine, and medical devices.

Overall, China’s biotech sector is experiencing rapid growth and is becoming a significant player in the global landscape, with these hubs leading the way.

Articles of Interest on International Biotech Venture Investment on the Open Access Scientific Journal Include:

CAR T-Cell Therapy Market: 2020 – 2027 – Global Market Analysis and Industry Forecast